Contents:

Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Comparing long or short positioning with historical extremes can also be beneficial in identifying market extremums. Experience shows that there are absolute values which indicate a bought-out, or sold-out currency, and as the COT positioning hits these values, there’s a significant chance of a rapid reversal.

The most important thing to remember is that COT data is just another tool that should not be used in isolation when developing a trading strategy. The indicator displays levels on the chart with the maximum volume of Stop Losses set by other market participants. Sentiment analysis — the 4th dimension of tradingMany traders only focus on the price when looking at the market…

Once your https://trading-market.org/ is created, you’ll be logged-in to this account. Check all recently updated & newly posted forex articles, forex trade analysis, MetaTrader indicator manual update. If commercial long cross over the non-commericial long that definitely indicates market will now go into a bullish zone. Similarly, If commercial short cross below the non-commercial shorts that indicates market will not now go into a bearish zone. This was followed by CAD (-11.9k) and JPY where 5.3k lots of selling took the net short to within 90% of the recent peak at -111.8k lots.

How to Read the COT Report and Use It in Forex Trading?

The same is true if we’re in a bearish trend and the commercial traders are buying at extreme pace – then we’re close to a significant low in the market. In Figure 2we have the Japanese Yen futures contract, and the COT Report is highlighted at the bottom of the chart. Buying JPY future contracts is a typical long-term strategy for the large speculators that involves trading against the small speculators because they are usually wrong at most market turning points.

You hereby waive the benefit of Swiss banking secrecy in this respect towards the above mentioned persons and entities. Confidentiality of your personal data will be ensured throughout the group, regardless of the location of specific group units. FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET. Dealer/Intermediary – typically ‘sell-side’ and include large banks and dealers in swaps, securities and other derivatives. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here.

Web Trader platform

So, it is wise for a trader to concentrate more on the non commercial market positional data more for reliability in capturing the trade positions. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment.

If both the number of the long positions and the number of the short positions rise or fall simultaneously, then no trading signal is generated. Other Reportables – typically ‘buy-side’ and include reportable traders that that do not fit into none of the first three categories. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

These measures can give you an idea if there is room to move or suggest whether it has become a consensus trade. Is there any interest/money left to fuel the trend or is time begin locking some profits or looking for signs of reversals. The inverse relationship of these 2 groups illustrated in this chart confirms that speculators and commercial traders take opposite positions. Net Noncommercial Positioning is the difference between the short and long open interest of noncommercial traders. Net positioning offers a particularly good measure of CoT data and tends to follow the price action.

S&P 500 Price Forecast – Stock Markets Continue to Shutter On Higher Interest Rates

The most simple way would be to buy a currency pair whenever the number of Dealer long contracts rise and short contracts fall. Of course, there are numerous modifications possible based on adding some other categories into the formula or using additional market data for entries or exists. Noncommercial traders are speculators, such as individual traders, hedge funds and large institutions, which operate on the futures market and meet the reporting requirements. The COT reports are based on position data supplied by reporting firms . CFTC staff does not know specific reasons for traders’ positions and hence this information does not factor in determining trader classifications. Note that traders are able to report business purpose by commodity and, therefore, can have different classifications in the COT reports for different commodities.

Leveraged margin trading and binary options entail a high risk of losing money rapidly. Long Noncommercial Positioning represents the long open interest of noncommercial traders. The COT is a key data source for traders, as it can provide guidance on whether to go long or short on each market. The Commitments of Traders report is read in tables, in which each row will tell you the market and each column looks at the open interest, long positions and short positions.

In other words, it is the total volume of open contracts in the market, but not the transactions. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

The COT report is a powerful tool that gives any trader the flexibility to follow different paths when creating their trading strategy. The most important part is to remember that the COT data is another tool and shouldn’t be used alone when making a trading strategy. Conservative traders look at the COT as a way to check if the volume traded compliments use technical analysis.

COT Report as a Consensus Indicator

Let us now suppose that the non-commercial sector is overall long the USD in our example. COT reports are based on position data supplied by reporting firms . While the position data is supplied by reporting firms, the actual trader category or classification is based on the predominant business purpose self-reported by traders on the CFTC.

- The noncommercial participants are split between managed money and other reportables.

- It’s also gives helpful direction for determining which cross to trade.

- As previously mentioned, the COT Report is not a timing tool, but as highlighted on the chart, the commercial’s short trades had been at a record for almost three consecutive months before any real selling was observed.

- This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories.

- The long report, in addition to the information in the short report, groups the data by crop year, where appropriate, and shows the concentration of positions held by the largest four and eight traders.

For IMM currency futures and the VIX, we use the broader measure called non-commercial. To improve your results, use the COT report data to supplement your technical analysis from other forex trading tools. A commercial trader trades on behalf of a business or institution.

So just because Open Interest has not changed does not mean that the players outlook on the https://forexarena.net/ hasn’t changed. Hypothetically, a large number of speculators holding long contracts could be acquired by new commercial buyers. You would not detect this “new interest” in the market because new contracts weren’t created, but what is just as important is that existing contracts were acquired by parties with different market outlooks. In this case speculators holding contracts with the expectation of price increasing sold to commercial buyers who now hold these long contracts as they expect price to fall. Open interest has not changed but the players expectations on what price will do has. It is a very powerful tool though and it is important to understand how it can be applied to improve your trading.

They are smaller-account speculators who want to profit from the futures market as well. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider.

With the BOJ governor Kuroda set to hand over the rehttps://forexaggregator.com/ns and hold his last meeting in March, it’s possible we may see the central bank abandon YCC and / or negative interest rates. Yet whist gross shorts are now at a 22-month low, we’re yet to see a notable pickup of new long bets. I’d like to view FOREX.com’s products and services that are most suitable to meet my trading needs.

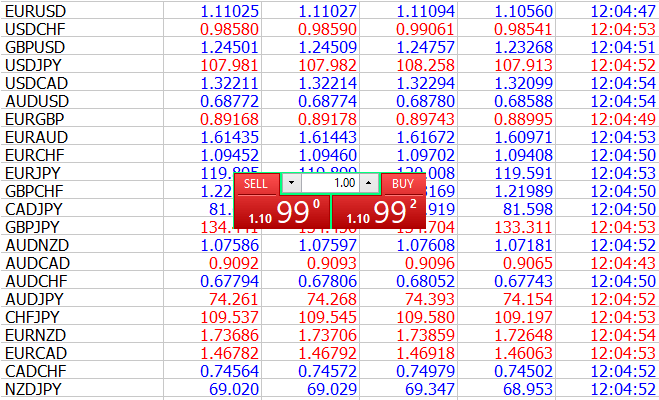

- All 7 major currency pairs can be quickly checked and the respective entries and exits executed.

- The most important thing to remember is that COT data is just another tool that should not be used in isolation when developing a trading strategy.

- Crisis-proof ETF strategy – Surviving a CrashThis strategy is easy to implement and has achieved a double-digit return…

- It is used by many futures traders as a market signal on which to trade.

- An exceptionally useful and prudent use of the COT report is regarding it as a volume complement to the price studies generated by conventional technical analysis.

Introduction and Classification MethodologyThe Commodity Futures Trading Commission publishes the Commitments of Traders reports to help the public understand market dynamics. The COT reports provide a breakdown of each Tuesday’s open interest for futures and options on futures markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. Clearing members, futures commission merchants, and foreign brokers file daily reports with the Commission. Those reports show the futures and option positions of traders that hold positions above specific reporting levels set by CFTC regulations. The aggregate of all traders’ positions reported to the Commission usually represents 70 to 90 percent of the total open interest in any given market.

Commitment of traders report (COT): – FOREX.com

Commitment of traders report (COT):.

Posted: Mon, 30 Jan 2023 08:00:00 GMT [source]

And, knowing where most Forex players are standing when creating a trading strategy. A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded. The Commitment of Traders report is a weekly publication that shows the aggregate holdings of different participants in the U.S. futures market.